Group Fourteen

Cover Letter

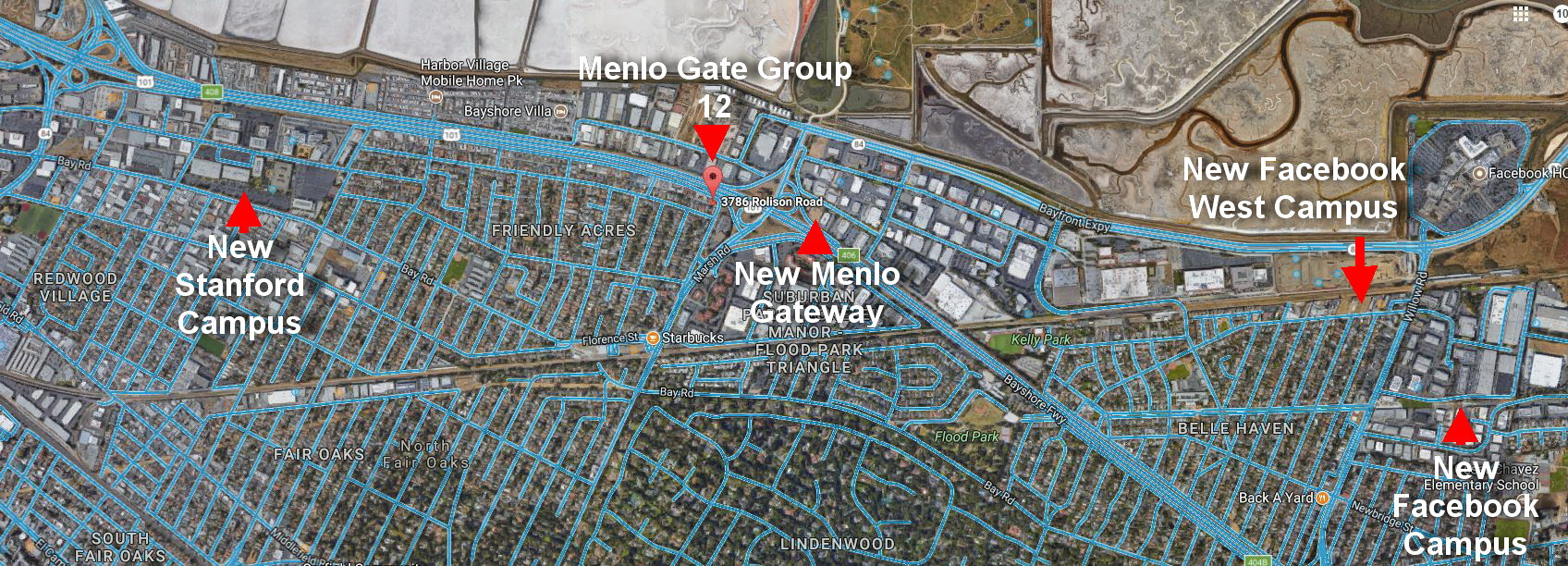

Menlo Gate, LLC is pleased to announce its next offering, Menlo Gate Group Fourteen, LLC. This offering group consists of a ten unit apartment opportunity in Menlo Park, CA located in the heart of numerous new Mid-Peninsula development projects including the Stanford Campus, Facebook’s Willow Campus addition, the Bohanon Park development, and the new Nia Hotel. The Stanford, Bohanon, and Nia Hotel projects have already broken ground and are underway. The new Facebook Willow Campus is expected to be completed by 2021.

The new Stanford development will occupy the old Technology Park in neighboring Redwood City and consist of over 35 acres of new development. Stanford forecasts that the new campus will bring over 3,000 new jobs to the area. Stanford has also dedicated a “trolley” system from the new campus to the revitalized downtown district of Redwood City.

The new Facebook Willow Campus is literally a city unto itself including office, retail, and its own grocery store. The new Bohanon Park development is an eight story office building at the corner of 101 and Marsh Rd. The beautiful Nia Hotel is located next door. A large parking structure and fitness center are also under construction in this area.

Large high end residential developments were also recently completed on both Willow Rd. and Hamilton St. in this area. The Willow Rd. project was entitled and completed by the Mid-Peninsula group whereas the 777 Hamilton project was brought to market by Sequoia’s, William Butler. The recent activity by both these large and respectable builders stands as a strong indicator as to the highly valuable future for real estate in this area. Menlo Gate’s latest acquisition is literally at the epicenter of all these developments!

This is an off market transaction that was obtained by Menlo Gate through our contact network. It is beyond argument that this area of Menlo Park will be one of the best appreciating districts in San Mateo County for the foreseeable future. As Facebook and other technology companies continue to expand their footprint in this corridor, the redevelopment and continued improvement of this area will positively impact real estate values in this sector of Menlo Park.

Below, please find Menlo Gate’s Offering Letter for this property along with pro forma financials for this Menlo Gate offering.

Three and a half shares of this group have been sold to Menlo Gate, LLC participants who previously submitted their Subscription Reservation Forms. There are two and a half shares remaining. Full, half, quarter, and eighth shares available.

We expect these remaining shares to go quickly, so please do not hesitate to contact us regarding your interest and to answer any questions. You may also call us directly at 650.255.9460 with any questions.

Offering Letter

We have been monitoring the Bay Area real estate market closely. Demand for rental housing is higher than ever before. At the same time, market inventory is historically low. The majority of rental property transactions are conducted off-market. Sellers are actively engaging in up leg IRC 1031 transactions and trading up their portfolios. Sellers are picking their transaction partners very carefully and choosing to sell their properties through broker relationships as opposed to the MLS. As a result, few properties, if any, are actually making it to market. This, in turn, has been driving prices up.

The Mid-Peninsula, as we have all seen, continues to undergo a complete metamorphosis. The Redwood City downtown area has physically changed its landscape and scheduled construction continues to impact all sectors of the Redwood City market including, but not limited to, residential, multi-family, retail, and office.

Further, Menlo Park’s Marsh Road to Willow Road, Facebook Corridor, is literally changing from day to day. Multiple projects currently under construction include the Menlo Gateway office building, Niko Hotel, a new fitness center, and Facebooks newest Bayshore office building. The new Mid-Peninsula Housing project on Willow Road was recently brought to market this year. Further, Sequoia’s 777 Hamilton is now complete and going to market as this is being written. The only word to describe this area is “metamorphosis.” The wave is building to a crescendo in this area and this offering group is designed to capture significant upside appreciation. This area of Menlo Park is on the verge of experiencing the same upward trend that has driven Redwood City to the top of the Mid-Peninsula market.

The New Stanford Campus

Add to this the addition of the new Stanford University Campus on Bay Street in Redwood City. Some 2,400 employees will work on the site of the former Mid-Point Technology Park off Highway 101, about 5 miles from the main campus. The new campus will initially develop 21 of the 35 available acres. It will feature modern offices, a fitness center and pool, a town square and a park, among other amenities. Stanford has also agreed to pay for the installation of a new public transport trolley that will service the new campus and the Fair Oaks District where the Menlo Gate Group Twelve property is located. The new trolley will allow easy access from the Fair Oaks District to the vibrant Redwood City Downtown corridor. Groundbreaking has commenced, pads have been poured, and construction is underway.

The New Facebook Campus

Facebook is expanding again. It’s been just over two years since Facebook moved into its 430,000-square-foot, headquarters in Menlo Park, Calif. Now the company is ready to expand again, and this time it wants to build a lot more than just office space for its workers. Plans have been approved for Facebook’s construction of what it will call its “Willow Campus,” a “mixed-use village” that sounds like a combination of a strip mall, a condo complex and an office park. The new campus, which will be right behind Facebook’s existing headquarters in Menlo Park on a site the company acquired in 2015. It includes office, retail, a grocery store, a pharmacy, and much more. All of this will be open to the public, according to the company’s blog post. There will be 125,000 square feet of retail space in total, and 1.75 million square feet of office space. A Facebook spokesperson announced that the new Willow Campus project will be completed by 2021. This campus will be in addition to the company’s existing office space, not a replacement for it.

Bohanon Park Development

The Bohannon Company has nearly completed construction of the new Menlo Gateway, an eight-story, 210,000-square-foot office building in Menlo Park. The mixed-use project also consists of a 1,040-space parking structure and a 41,000-square-foot fitness center. This property is located adjacent to the construction of a new hotel along the 101 corridor in Menlo Park. “The supply-constrained Menlo Park office market, combined with demographic and economic tailwinds, provide exceptional fundamentals for a project of this scale and quality,” Michael Mestel, Square Mile’ principal, said in a press release. The project is part of the first phase of Menlo Gateway, a 16-acre master-planned development comprised of a 250-room Autograph Collection hotel currently under construction and a total of approximately 500,000 square feet of office space to be built in phases. Located at 100 Independence Drive, the office building capitalizes on the site’s excellent visibility from the highway, and is oriented to maximize southern exposure and natural light. Menlo Park is known as a hub for high technology and attracts many of the nation’s most prominent technology and venture capital firms, including Intuit, SRI International, TE Corporation, Andreessen Horowitz and Sequoia Capital. A second phase of the Menlo Gateway project will include two additional office buildings, a café/restaurant, as well as neighborhood retail and community facilities, all totaling roughly 500,000 square feet of space.

A Unique 10 Unit Apartment Value-Add Acquisition Opportunity Centrally Located within Menlo Park’s New Development Pocket:

Menlo Gate has been actively pursuing leads and off market opportunities within the Stanford-Facebook-Bohanon development pocket. Needless to say, there are limited opportunities in this area and many properties are sold with a development premium. Many sellers are aware of the new developments and are asking prices which include what we refer to as a “new development premium.”

The company’s efforts continue to pay dividends. Menlo Gate, LLC has locked down a fantastic opportunity for its participants, a 10 unit apartment opportunity located in the heart of the three Stanford-Facebook-Bohanon developments in the thriving community of Menlo Park. Based on the addition of the new Stanford Campus, proximity to the new Facebook and Bohanon developments, implementation of new zoning laws, and a Fair Oaks trolley system, we believe this area of Menlo Park will be one of the highest appreciating district in all of San Mateo County over the next 5 years.

We have prepared and attached draft pro forma financials for Menlo Gate’s next Offering Group for a 10 unit apartment opportunity located in Menlo Park, CA. This offering consists of two 5 unit buildings that are located on contiguous parcels. Further, the property is located within walking distance to the new Stanford campus and the Facebook and Bohanon developments. The property also provides for easy access to the local up and coming downtown of Redwood City.

This is an off-market transaction that has come to us through our network. The seller is engaged in a trade up IRC 1031 transaction and wants to ensure that the timeline is controlled. Accordingly, the seller brought this offer to Menlo Gate at a very attractive sales price in order to ensure that the deal would go through without any issues. At the close of negotiations, we were able to enter into contract with the seller for an extremely below market contract price of $346K per door.

A review of local comparable listings and sales reveals that this Menlo Gate Offering Group provides for captured equity in the range of $400,000 to $500,000. There are multiple closed transactions in Menlo Park well above this per door price in far less desirable locations.

Over the last year, we have seen the Bay Area rental market escalate rapidly with very low levels of multi-family properties on the market. Very few owners are bringing their assets to market. There is simply no incentive for owners to transact as they have watched their rent rolls swell. Further, real estate analysts and prognosticators have estimated that vacancies will dip below 4% nationally this year. Vacancy levels are expected to be even tighter in the Bay Area and especially on the mid-Peninsula. As vacancy rates decline, it is estimated that rents will climb as high as 10% year to year for the next three years. Therefore, we have seen a tightening of the multi-family market as owners take advantage of low interest rates and position themselves for the long term hold. Simply put, Redwood City rental real estate continues to be the darling of the real estate industry and prices are escalating rapidly.

Pro Forma Financials and Assumptions:

The attached pro forma financials necessarily incorporate certain assumptions that are typical in the context of forecasting valuations for real estate investments. These assumptions are overviewed below and should be kept in mind in the course of reviewing the attached pro forma financials.

Comparable Sales And Captured Equity

The average market rent for a one-bedroom apartment in San Mateo County is $2,959 per month, up from $2,572 in 2016, according to new rental data released by the San Mateo County Department of Housing (see https://www.rentjungle.com/average-rent-in-san-mateo-rent-trends.) This reflects a 15 percent increase from last year. Escalating rents have translated into rising per door prices for multi-family acquisitions as net operating incomes have risen due to higher rental values. The company believes that it has acquired the subject property significantly under market due to seller’s 1031 transaction and desire to control his sale/replacement property transaction. This translates into captured equity for the investors. The company conservatively estimates captured equity range of $400,000 to $500,000.

Rental Value

The property consists of 8 one-bedroom units and 2 two-bedroom in Menlo Park, CA adjacent to the new Stanford campus, Facebook Willow Campus, and the new Bohanon Park development. All units are permitted as part of the original construction, there are no unwarranted units. All units are presently rented at a below average rental rate. Based on similarly situated buildings in this location, Menlo Gate estimates that there is a significant upside in rents for this location. Further, this will increase as the new developments referenced herein are brought to completion and market demand for housing in this area increases. The Company owns and manages units in this area and is currently receiving rents of $1900 for one-bedrooms and $2750 for two-bedrooms. Based on the rental estimates above, we have run the attached pro forma financials at a combined annual rent of $248,400. We conservatively estimate a conservative annual rental increase of 5%. The financials also reflect an equivalent vacancy rate for a one bedroom unit going vacant for two months (2.5% vacancy rate). For the record, we generally do not see units go vacant for more than a month, even in the worst of times.

Further, there is a coin-operated laundry facility in a separate laundry room at the property. The laundry room has a pair of machines set at fair market rates for laundry. We have estimated a monthly income of $200 per month, or $2,400 annual, from the coin-operated laundry. Moreover, we have added an income line of $50 per unit/per month for the recovery of utility costs from tenants through Ratio Utility Billing Systems (“RUBS”). RUBS allows the company to recover pro-rated utility (i.e. water and sewer charges) from the tenants based upon occupancy and use. This equates to an additional $3,600 in RUBS income.

Financing

The property is being acquired with a seven year fixed product from one of the company’s portfolio lenders. Due to Menlo Gate’s operational history and relationship with this lender, we have received a Letter of Intent for this acquisition at 3.50%. The pro forma financials reflect present financing rates and terms at 3.5% for the seven year hold term.

Repairs

Pursuant to our walk through inspection, the building appears to be in structurally excellent condition. All units are standardized in their modernization. There is limited deferred maintenance. Any foreseen repairs would be to units during turnovers to modernize the units. These property improvements, however, will be paid for using either tenant deposit withholdings or the cash flow from the property that is discussed further below. The repairs will be performed during tenant turnovers or at the discretion of the management. The pro forma financials also incorporate an annual repair expenditure of $8,400 per year for maintenance of the property. Although we do not expect to require this amount in annual maintenance for the property, this amount is incorporated in order to insure that the pro forma financials reflect a conservative approach for the participant.

Expected Sales Price

We have calculated the appreciation for the property at 5% over the next seven years. For those of us that follow the Bay Area market closely, this is a conservative number based upon the timing of the acquisition and the much anticipated delivery to market of the new Stanford Campus, Facebook Willow Campus, and Bohanon Park development. Based on this calculation, the property has a resale value of over $4,784,141.00 after seven years at 5% appreciation. Accordingly, the estimated appreciation for this property is estimated at $1,384,141. The appreciation for the property over seven years may exceed or fall short of this number. The estimated appreciation rate, however, represents a conservative number for the appreciation of Bay Area real estate. The expected sales price based upon appreciation is also calculated using the contracted for purchase price of $3,400,000 which we believe to be a significantly “under market” value for this property. The figures represented in the pro forma financials are dependent upon risk factors overviewed in the private placement memorandum located at Menlo Gate’s website.

Cash Flow

Based upon the pro forma financials, the property has an estimated cash flow of approximately $72,350.00 (see Cash Flow Before Tax) during the first year of operation. This provides the investor with an approximate 5.23 % cash on cash return on investment at a 5.36% capitalization rate. The total estimated cash flow over the seven year holding period is $583,002. This number incorporates rent escalation which necessarily increases the projected distribution per investor over the holding period. (See Pro Forma, Page 7, Long Term Financial Forecast, Total, Cash Flow After Taxes.) Accordingly, it is anticipated that there will be distributions to the each Full Share member over the period of ownership of approximately $83,286.00 (this calculation includes the company’s carried interest distribution). This is due, in part, to the down payment of $1,360,000 for the property from the Menlo Gate Group Fourteen capital pool and the ability to capitalize on the beneficial financing rates for this transaction. These figures do not account for asset appreciation attributable to the investment. The internal rate of return on investment with appreciation with these assumptions is 14.80% per participant. These figures represent estimated returns based upon the pro forma financials and are dependent upon the risk factors overviewed in the private placement memorandum located at Menlo Gate’s website.

As always, we are here to help and are available to answer any questions you may have following your review of the attached pro forma financials. We also encourage all potential members to seek the independent advice of their tax consultant, attorney, or accountant regarding this or any significant investment. It is our goal to provide each investor with a conservative investment vehicle that takes advantage of the leveraged rates of return of real estate.

This offering is limited to six members. The offering amounts for Menlo Gate Group Fourteen are as follows:

Full Share: $250,000

Half Share: $125,000

Quarter Share: $62,500

Eighth Share: $31,250

Subsequent to Menlo Gate, LLC’s receipt of confirmation of full conscription, this group will be closed.

We look forward to hearing from you and thank you very much for your continued support of Menlo Gate, LLC!

Closing Letter

Menlo Gate, LLC is pleased to announce that it has closed, Menlo Gate Group Fourteen, LLC. This offering group consisted of a ten unit apartment opportunity in Menlo Park, CA located in the heart of numerous new Mid-Peninsula development projects including the Stanford Campus, Facebook’s Willow Campus addition, the Bohanon Park development, and the new Nia Hotel. The Stanford, Bohanon, and Nia Hotel projects have already broken ground and are underway. The new Facebook Willow Campus is expected to be completed by 2021.

The new Stanford development will occupy the old Technology Park in neighboring Redwood City and consist of over 35 acres of new development. Stanford forecasts that the new campus will bring over 3,000 new jobs to the area. Stanford has also dedicated a “trolley” system from the new campus to the revitalized downtown district of Redwood City.

The new Facebook Willow Campus is literally a city unto itself including office, retail, and its own grocery store. The new Bohanon Park development is an eight story office building at the corner of 101 and Marsh Rd. The beautiful Nia Hotel is located next door. A large parking structure and fitness center are also under construction in this area.

Large high end residential developments were also recently completed on both Willow Rd. and Hamilton St. in this area. The Willow Rd. project was entitled and completed by the Mid-Peninsula group whereas the 777 Hamilton project was brought to market by Sequoia’s, William Butler. The recent activity by both these large and respectable builders stands as a strong indicator as to the highly valuable future for real estate in this area. Menlo Gate’s latest acquisition is literally at the epicenter of all these developments!

This was an off market transaction that was obtained by Menlo Gate through our contact network. It is beyond argument that this area of Menlo Park will be one of the best appreciating districts in San Mateo County for the foreseeable future. As Facebook and other technology companies continue to expand their footprint in this corridor, the redevelopment and continued improvement of this area will positively impact real estate values in this sector of Menlo Park.

If you missed this great opportunity, please keep an eye out for Menlo Gate’s next offering. We expect our next group to be published to our participant in list in Q1 of 2018. You can also reach out to us via email if you have any questions or to advise us of your level of interest in our next group.